WE GROW, SELL AND BUY BUSINESSES

Selling or acquiring companies is a fine art. Its a little like cooking, some ingredients go well together, and others do not. We make these distinctions and simplify this process. We work hard to find solutions that address concerns for both the buyers and sellers, we believe that everyone should win in a transaction and thats our goal, to find this ground.

Acquisitions is the fastest way to grow a company and realize its full potential. Once we acquire a company we look to implement proven strategies to grow revenue. Revenue can grow very quickly during this process, allowing working capital to be released and introduce professional management and introduce standard operating procedures. Once implemented the company can then be scaled rapidly. This process increases the valuation of the company in turn freeing resources to acquire new companies and replicate the process.

WE HELP BUSINESSES FLOURISH

Corner rock works with over 100 private investors, this gives us access to extensive professionals & an advisory of board of leading experts.

Our team has incorporated over six different companies on the INC 500 fastest growing companies list. dealing in both large and small businesses, ranging in value between 10m and 1 billion dollars.

We understand the complexities of business, and the importance to get things right the first time. Owners can be reassured that their businesses will flourish in our hands. We implement leading experts and experienced operators in their industry, ensuring companies are run effectively and efficiently. Being a boutique firm that only specializes Real estate service's allows us to be leading experts in this field and move quickly. We have over 196 different proven strategies to accelerate sales and a further 50 proven strategies to increase valuations. People can expect to see results in as little as 12 months.

understanding how businesses are valued

Acquisitions is the fastest way to grow your company

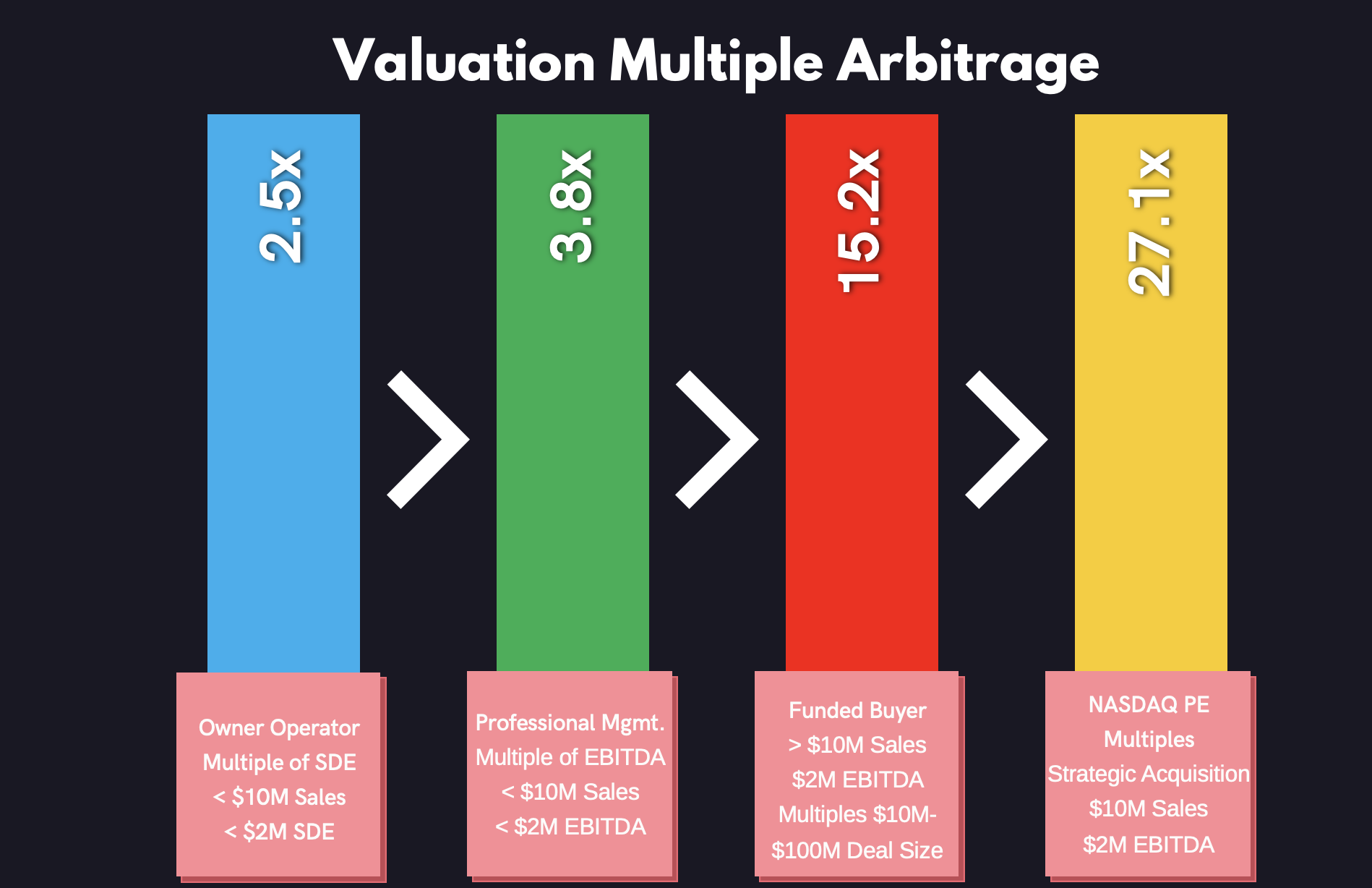

Keeping things very basic, most companies within the real estate services sector fall within the following AQ multiples. These are used to value your company based on a multiple of your earnings or EBITDA. Depending of the size of the company, its revenue and the systems it has in place, that multiple can increase or decreases. Our goal when acquiring a company is to help businesses progress to a higher multiple and in turn value by exiting to the right of the chart.

To summarise the multiples change based on four main stages they are as follows.

If your company is doing less than 10 million revenue and 2 million in SDE, generally a multiple of 2.5 applies to your SDE/earnings. If professional management is introduced or revenue increases to more than 10 million a 3.8 multiple on average is applied to the EBITDA.

Companies with more than 10 million in revenue with a professional management team & standard operating procedures can be sold for 15.2 EBITDA. These companies can be sold for up to 15.2 x EBITDA/Earnings. Generally the the buyers in these instances are private equity preparing the company for public offerings where they receive on average 27.1 time EBITDA or earnings.

We specialise in expediting this process, and doing it through cost effective means. Maximising the return for shareholders and investors.

So how long does this process take?

The results can range depending on a number of complexities, generally speaking though, with effective management you can expect the following the following results.

Within 12 months the company value would have increased its earnings multiple from 2.5 SDE to a minimum of 3 x Ebitda, to around double the value or more. By year 2-3 the company would have increased in value between 2 - 7 times since.

Years 4-5 the company will grow at a similar rate between 1 - 7 x times the value. Please remember though, as the companies value is a lot more by this time the increase in dollars is substantially more.

This is where the magic happens, funds can now be released through financing tax free and rolled into further acquisitions diversifying interests and increasing the return on initial investment. This process is then replicated and repeated again and again.

Fire Protection/Life Safety

Electrical services

Heating ventilation and cooling

Plumbing & Roofing

Real Estate Agencies

Storage Facilities

Let's work together

WE WELCOME THE OPPORTUNITY TO WORK WITH YOU. PLEASE GIVE US A CALL FOR A CONFIDENTIALLY FRIENDLY CONVERSATION ABOUT YOUR BUSINESS